You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

USA eBay import fees question

- Thread starter edd_jedi

- Start date

monkey_roo

Sith Lord

- Joined

- Apr 1, 2011

- Messages

- 2,420

- Reaction score

- 665

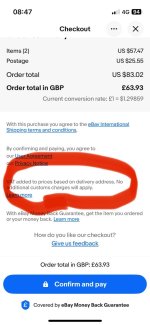

Not sure this helps - but I think it is all down to how the person sets up the auction - I've had it both ways in the last year (no pun intended) - It's basically a lottery. I've also had it where the disclaimer is there and nothing gets added this end and times where it is added. Basically if think it's best to assume you get hit with a charge whatever and then its a nice surprise if you don't

When I get this situation, and I have before, I add the item to my basket and then see what it says when I try to check out, but don’t actually check out…if you follow.

If it adds fees then I wouldn’t expect to get any more.

Alternatively speak to the seller, he may ship to you directly?

Good luck.

If it adds fees then I wouldn’t expect to get any more.

Alternatively speak to the seller, he may ship to you directly?

Good luck.

- Joined

- Apr 3, 2014

- Messages

- 9,141

- Reaction score

- 645

I wanted to ask this question as well!

lejackal

Grand Master

- Joined

- Jul 1, 2015

- Messages

- 9,268

- Reaction score

- 1,808

I saw the same thing on an item I want. With postage it’s cheaper than I can find one for in the UK, but only if I don’t get slapped with the potential extra charges. Sadly I’m going to suck it up and just buy the one in the UK

lejackal

Grand Master

- Joined

- Jul 1, 2015

- Messages

- 9,268

- Reaction score

- 1,808

This next bit was on another collecting group:

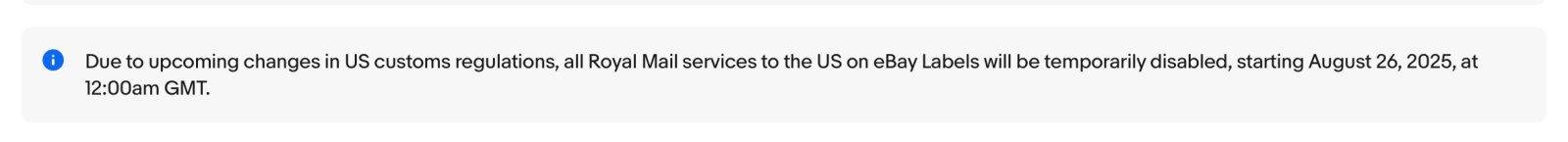

As you may or may not know, certain tariffs start taking place August 31, 2025.

Here is the quick and dirty of it and how it may affect you when buying, selling or trading on the page. (PERSONAL- NOT BUSINESSES)

BUY & SELL

America- ALL inbound packages from another country, no matter the declared value are subject to tariffs as per country of origin. Typically 25% but check with either your post office or the government website.

There is an exception for declared gifts of no more than $100 usd per person/ daily. You need to clearly state that on your customs forms.

The rest of the world- incoming packages from the states may be subject to tariffs according to your country's tariff strategy.

Please check with your post office and/ or government website.

So as an example- in Canada we have 25% on all incoming goods from America ( as I write this anyways), with an exemption of anything declared as a gift under $60 cad.

YOU are responsible to pay these tariffs when the packages arrives. It is NOT the responsibility of the seller to collect these prior to. ( unless that's part of your country's tariff strategy- so far I've not seen it for personal- just businesses)

TRADING

Same as above applies and depends how the 2 of you decide how to manage the trade

.

Option 1. Both considered as buyers and you must list as gifts under the tariff exemption limits.

Option2.

Both considered as sellers and you pay via PayPal the exact same amount for payment protection. Otherwise same as option 1.

OTHER CONSIDERATIONS.

Some shipping businesses and country postal services have now declared that they are no longer shipping nor receiving small packages unless they are under the $100 USD gift exemption; to and from America.

Check with your shipping vendor prior to giving a potential buyer a quote.

Big purchases to and from America will incur tariffs and duty imports. This is unavoidable unless you take considerable risk as declaring as a gift under the exemption totals. That also means you can't get shipping insurance more than the exemption total declared.

So if you're in the market to buy/ sell something big like a thunderhawk from/ to America; it's probably too late to avoid the tariffs. Your LE metal thunderhawk just got 25% more expensive.

Most other countries don't have tariffs on each other. So as an example I'm in Canada, and shipping to Australia- business as usual ( regular shipping costs, duties and levies apply).

That's it!

Happy to try and answer questions but we are not experts in this. We ask you reach out to your federal governent websites regarding tariffs and postal offices.

As you may or may not know, certain tariffs start taking place August 31, 2025.

Here is the quick and dirty of it and how it may affect you when buying, selling or trading on the page. (PERSONAL- NOT BUSINESSES)

BUY & SELL

America- ALL inbound packages from another country, no matter the declared value are subject to tariffs as per country of origin. Typically 25% but check with either your post office or the government website.

There is an exception for declared gifts of no more than $100 usd per person/ daily. You need to clearly state that on your customs forms.

The rest of the world- incoming packages from the states may be subject to tariffs according to your country's tariff strategy.

Please check with your post office and/ or government website.

So as an example- in Canada we have 25% on all incoming goods from America ( as I write this anyways), with an exemption of anything declared as a gift under $60 cad.

YOU are responsible to pay these tariffs when the packages arrives. It is NOT the responsibility of the seller to collect these prior to. ( unless that's part of your country's tariff strategy- so far I've not seen it for personal- just businesses)

TRADING

Same as above applies and depends how the 2 of you decide how to manage the trade

.

Option 1. Both considered as buyers and you must list as gifts under the tariff exemption limits.

Option2.

Both considered as sellers and you pay via PayPal the exact same amount for payment protection. Otherwise same as option 1.

OTHER CONSIDERATIONS.

Some shipping businesses and country postal services have now declared that they are no longer shipping nor receiving small packages unless they are under the $100 USD gift exemption; to and from America.

Check with your shipping vendor prior to giving a potential buyer a quote.

Big purchases to and from America will incur tariffs and duty imports. This is unavoidable unless you take considerable risk as declaring as a gift under the exemption totals. That also means you can't get shipping insurance more than the exemption total declared.

So if you're in the market to buy/ sell something big like a thunderhawk from/ to America; it's probably too late to avoid the tariffs. Your LE metal thunderhawk just got 25% more expensive.

Most other countries don't have tariffs on each other. So as an example I'm in Canada, and shipping to Australia- business as usual ( regular shipping costs, duties and levies apply).

That's it!

Happy to try and answer questions but we are not experts in this. We ask you reach out to your federal governent websites regarding tariffs and postal offices.

StarWarsFan

Grand Master

- Joined

- Apr 2, 2015

- Messages

- 7,576

- Reaction score

- 1,251

Bloody annoying!!!!!

StarWarsFan

Grand Master

- Joined

- Apr 2, 2015

- Messages

- 7,576

- Reaction score

- 1,251

Nice one EddIt arrived today with no extra customs fees due